Products

A Plug & Play Software, with multiple products, tailor-made to serve Investment Firms.

Fully integrated with and Powered by

Compliance Made Analytical at FinKit

A hub for automating complex regulatory requirements, quantifying regulations, and keeping you ahead of competitors.

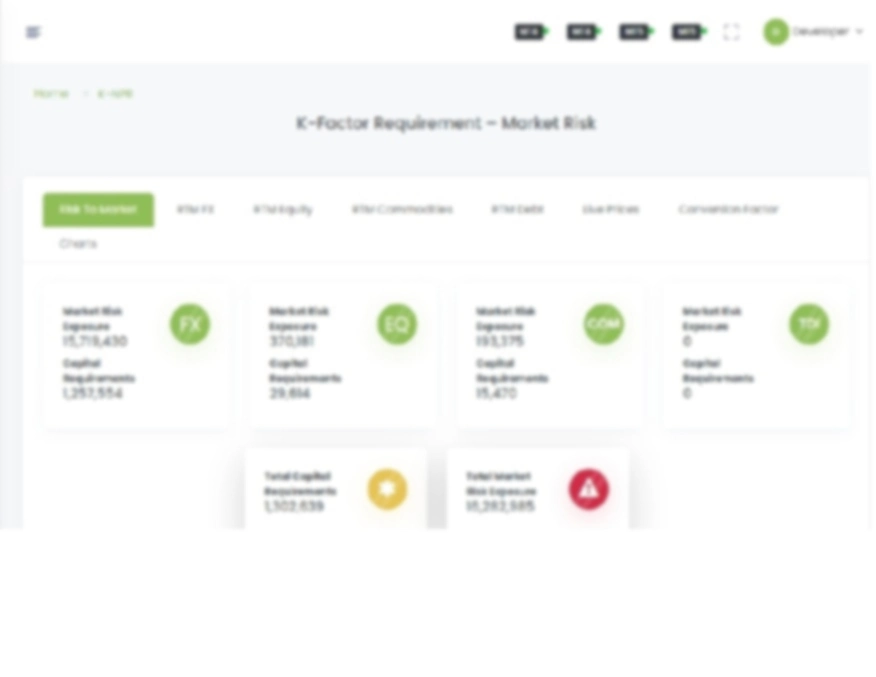

IFR/IFD

The Investment Firm Regulation and Investment firm Directive of 2019 addresses new risks investment firms poses to clients (RTC), to market (RTM), and to firm (RTF) as manifested by K-Factors. Get them in real time with FinKit..

Read MoreQuarterly Statistics QST

Meet quarterly reporting deadlines with ease, in a timely manner, using consolidated data sourced from multiple trading platforms, and gain an edge with business intelligence.

Read MoreAnti-Money Laundering Transaction monitoring

Compliance with the latest AML directive for AML suspicious transactions screening by utilizing a technology that is built specifically for CFD-regulated investment firms.

Read MoreSafeguarding & Reconciliation Of Client's Funds

Prove adequate arrangements are in place to safeguard the ownership rights of clients through a fully integrated solution, performing automated daily reconciliations and highlighting shortfalls.

Read MoreCommon Reporting Standards CRS

Tax Authorities nowadays are keenly alert to Investment firms’ CRS reporting. We simplify the process by extracting the needed data and generating the necessary XML files for submission.

Read More